0

0

0

ACRE Act of 2023

12/7/2023, 5:06 PM

Summary of Bill S 2371

The ACRE Act of 2023, also known as Bill 118 s 2371, is a piece of legislation introduced in the US Congress aimed at addressing agricultural conservation and rural economy (ACRE) issues. The bill focuses on providing support and resources to farmers and ranchers to promote sustainable agricultural practices and protect natural resources.

Key provisions of the ACRE Act include:

1. Increasing funding for conservation programs: The bill allocates additional funding to existing conservation programs, such as the Conservation Reserve Program (CRP) and the Environmental Quality Incentives Program (EQIP), to help farmers implement conservation practices on their land. 2. Promoting soil health and water quality: The ACRE Act emphasizes the importance of soil health and water quality in sustainable agriculture. It includes measures to incentivize farmers to adopt practices that improve soil health, reduce erosion, and protect water sources. 3. Supporting rural economic development: The bill includes provisions to support rural economic development by investing in infrastructure projects, expanding access to broadband internet, and promoting local food systems. These initiatives are aimed at creating jobs and boosting economic growth in rural communities. 4. Enhancing conservation research and education: The ACRE Act prioritizes funding for research and education programs that focus on agricultural conservation practices. This includes funding for universities, extension services, and other institutions that provide technical assistance to farmers. Overall, the ACRE Act of 2023 seeks to address the challenges facing the agricultural sector while promoting sustainable practices and protecting natural resources. By providing support and resources to farmers and ranchers, the bill aims to create a more resilient and environmentally friendly agricultural industry.

Key provisions of the ACRE Act include:

1. Increasing funding for conservation programs: The bill allocates additional funding to existing conservation programs, such as the Conservation Reserve Program (CRP) and the Environmental Quality Incentives Program (EQIP), to help farmers implement conservation practices on their land. 2. Promoting soil health and water quality: The ACRE Act emphasizes the importance of soil health and water quality in sustainable agriculture. It includes measures to incentivize farmers to adopt practices that improve soil health, reduce erosion, and protect water sources. 3. Supporting rural economic development: The bill includes provisions to support rural economic development by investing in infrastructure projects, expanding access to broadband internet, and promoting local food systems. These initiatives are aimed at creating jobs and boosting economic growth in rural communities. 4. Enhancing conservation research and education: The ACRE Act prioritizes funding for research and education programs that focus on agricultural conservation practices. This includes funding for universities, extension services, and other institutions that provide technical assistance to farmers. Overall, the ACRE Act of 2023 seeks to address the challenges facing the agricultural sector while promoting sustainable practices and protecting natural resources. By providing support and resources to farmers and ranchers, the bill aims to create a more resilient and environmentally friendly agricultural industry.

Congressional Summary of S 2371

Access to Credit for our Rural Economy Act of 2023 or the ACRE Act of 2023

This bill excludes from the gross income of certain financial lending institutions, for income tax purposes, interest received on loans secured by rural or agricultural real estate.

Read the Full Bill

Current Status of Bill S 2371

Bill S 2371 is currently in the status of Bill Introduced since July 19, 2023. Bill S 2371 was introduced during Congress 118 and was introduced to the Senate on July 19, 2023. Bill S 2371's most recent activity was Read twice and referred to the Committee on Finance. as of July 19, 2023

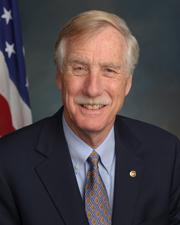

Bipartisan Support of Bill S 2371

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

2Democrat Cosponsors

0Republican Cosponsors

0Unaffiliated Cosponsors

2Policy Area and Potential Impact of Bill S 2371

Primary Policy Focus

TaxationComments

Sponsors and Cosponsors of S 2371

Latest Bills

ESTUARIES Act

Bill HR 3962December 13, 2025

Federal Maritime Commission Reauthorization Act of 2025

Bill HR 4183December 13, 2025

National Defense Authorization Act for Fiscal Year 2026

Bill S 1071December 13, 2025

Enduring Justice for Victims of Trafficking Act

Bill S 2584December 13, 2025

Technical Corrections to the Northwestern New Mexico Rural Water Projects Act, Taos Pueblo Indian Water Rights Settlement Act, and Aamodt Litigation Settlement Act

Bill S 640December 13, 2025

Incentivizing New Ventures and Economic Strength Through Capital Formation Act of 2025

Bill HR 3383December 13, 2025

BOWOW Act of 2025

Bill HR 4638December 13, 2025

Northern Mariana Islands Small Business Access Act

Bill HR 3496December 13, 2025

Wildfire Risk Evaluation Act

Bill HR 3924December 13, 2025

Energy Choice Act

Bill HR 3699December 13, 2025

ACRE Act of 2023

Bill HR 3139January 3, 2024