0

0

0

Repealing the Ill-Conceived and Problematic (RIP) Book Minimum Tax Act

12/29/2022, 1:18 PM

Congressional Summary of S 5017

Repealing the Ill-Conceived and Problematic (RIP) Book Minimum Tax Act

This bill repeals the 15% alternative minimum tax on corporations enacted by the Inflation Reduction Act of 2022.

Read the Full Bill

Current Status of Bill S 5017

Bill S 5017 is currently in the status of Bill Introduced since September 29, 2022. Bill S 5017 was introduced during Congress 117 and was introduced to the Senate on September 29, 2022. Bill S 5017's most recent activity was Read twice and referred to the Committee on Finance. as of September 29, 2022

Bipartisan Support of Bill S 5017

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

13Democrat Cosponsors

0Republican Cosponsors

13Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 5017

Primary Policy Focus

TaxationAlternate Title(s) of Bill S 5017

Repealing the Ill-Conceived and Problematic (RIP) Book Minimum Tax Act

Repealing the Ill-Conceived and Problematic (RIP) Book Minimum Tax Act

A bill to repeal the corporate alternative minimum tax.

Comments

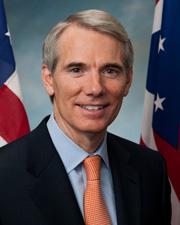

Sponsors and Cosponsors of S 5017

Latest Bills

National Defense Authorization Act for Fiscal Year 2026

Bill S 1071December 13, 2025

Enduring Justice for Victims of Trafficking Act

Bill S 2584December 13, 2025

Technical Corrections to the Northwestern New Mexico Rural Water Projects Act, Taos Pueblo Indian Water Rights Settlement Act, and Aamodt Litigation Settlement Act

Bill S 640December 13, 2025

Incentivizing New Ventures and Economic Strength Through Capital Formation Act of 2025

Bill HR 3383December 13, 2025

BOWOW Act of 2025

Bill HR 4638December 13, 2025

Northern Mariana Islands Small Business Access Act

Bill HR 3496December 13, 2025

Wildfire Risk Evaluation Act

Bill HR 3924December 13, 2025

Energy Choice Act

Bill HR 3699December 13, 2025

ESTUARIES Act

Bill HR 3962December 13, 2025

Improving Interagency Coordination for Pipeline Reviews Act

Bill HR 3668December 13, 2025

Repealing the Ill-Conceived and Problematic (RIP) Book Minimum Tax Act

Bill HR 9030December 29, 2022