0

0

0

Child Tax Credit for Pregnant Moms Act of 2022

12/30/2022, 3:49 AM

Summary of Bill HR 6505

Bill 117 HR 6505, also known as the Child Tax Credit for Pregnant Moms Act of 2022, is a piece of legislation introduced in the US Congress. The purpose of this bill is to provide a tax credit to pregnant women in order to support them financially during their pregnancy and after the birth of their child.

The bill proposes to amend the Internal Revenue Code to allow pregnant women to claim a tax credit of up to $2,000 for each child they are expecting. This tax credit would be in addition to the existing Child Tax Credit and would be available to pregnant women in the year in which they are expecting the child.

The bill aims to provide financial assistance to pregnant women who may be facing financial difficulties during their pregnancy. By providing this tax credit, the bill seeks to alleviate some of the financial burden that pregnant women may face, such as medical expenses, childcare costs, and other expenses related to pregnancy and childbirth. Overall, the Child Tax Credit for Pregnant Moms Act of 2022 is designed to support pregnant women and their families by providing them with additional financial assistance during a critical time in their lives. The bill is currently being considered by Congress and may be subject to further amendments before it is passed into law.

The bill proposes to amend the Internal Revenue Code to allow pregnant women to claim a tax credit of up to $2,000 for each child they are expecting. This tax credit would be in addition to the existing Child Tax Credit and would be available to pregnant women in the year in which they are expecting the child.

The bill aims to provide financial assistance to pregnant women who may be facing financial difficulties during their pregnancy. By providing this tax credit, the bill seeks to alleviate some of the financial burden that pregnant women may face, such as medical expenses, childcare costs, and other expenses related to pregnancy and childbirth. Overall, the Child Tax Credit for Pregnant Moms Act of 2022 is designed to support pregnant women and their families by providing them with additional financial assistance during a critical time in their lives. The bill is currently being considered by Congress and may be subject to further amendments before it is passed into law.

Congressional Summary of HR 6505

Child Tax Credit for Pregnant Moms Act of 2022

This bill allows a child tax credit for an unborn child who is born alive. It also allows the credit upon certification that a mother's pregnancy resulted in a miscarriage (the involuntary death of an unborn child who was carried in the womb for less than 20 weeks) or that the child was stillborn (the involuntary death of an unborn child who was carried in the womb for 20 weeks or more).

Read the Full Bill

Current Status of Bill HR 6505

Bill HR 6505 is currently in the status of Bill Introduced since January 25, 2022. Bill HR 6505 was introduced during Congress 117 and was introduced to the House on January 25, 2022. Bill HR 6505's most recent activity was Referred to the Subcommittee on Health. as of January 26, 2022

Bipartisan Support of Bill HR 6505

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

66Democrat Cosponsors

0Republican Cosponsors

66Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill HR 6505

Primary Policy Focus

TaxationAlternate Title(s) of Bill HR 6505

Child Tax Credit for Pregnant Moms Act of 2022

Child Tax Credit for Pregnant Moms Act of 2022

To amend the Internal Revenue Code of 1986 to provide a child tax credit for pregnant moms with respect to their unborn children, and for other purposes.

Comments

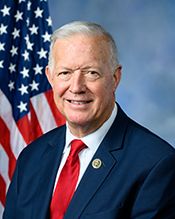

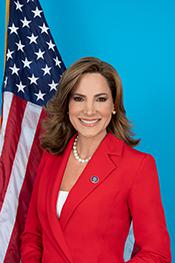

Sponsors and Cosponsors of HR 6505

Latest Bills

ESTUARIES Act

Bill HR 3962December 13, 2025

Federal Maritime Commission Reauthorization Act of 2025

Bill HR 4183December 13, 2025

National Defense Authorization Act for Fiscal Year 2026

Bill S 1071December 13, 2025

Enduring Justice for Victims of Trafficking Act

Bill S 2584December 13, 2025

Technical Corrections to the Northwestern New Mexico Rural Water Projects Act, Taos Pueblo Indian Water Rights Settlement Act, and Aamodt Litigation Settlement Act

Bill S 640December 13, 2025

Incentivizing New Ventures and Economic Strength Through Capital Formation Act of 2025

Bill HR 3383December 13, 2025

BOWOW Act of 2025

Bill HR 4638December 13, 2025

Northern Mariana Islands Small Business Access Act

Bill HR 3496December 13, 2025

Wildfire Risk Evaluation Act

Bill HR 3924December 13, 2025

Energy Choice Act

Bill HR 3699December 13, 2025

Child Tax Credit for Pregnant Moms Act of 2022

Bill S 3537December 30, 2022