0

0

0

DELIVER Act of 2025

3/27/2025, 6:08 PM

Summary of Bill S 895

Bill 119 s 895, also known as the "Charitable Mileage Rate Increase Act," aims to make a change to the Internal Revenue Code of 1986. Specifically, this bill seeks to raise the standard charitable mileage rate for the delivery of meals to elderly, disabled, frail, and at-risk individuals.

Currently, individuals who volunteer to deliver meals to those in need can deduct a certain amount per mile driven from their taxes as a charitable contribution. This bill proposes to increase that standard mileage rate, making it more financially beneficial for volunteers to participate in meal delivery programs.

The goal of this legislation is to incentivize more individuals to volunteer their time and resources to help those who are most vulnerable in our communities. By increasing the standard charitable mileage rate, lawmakers hope to encourage more people to get involved in delivering meals to elderly, disabled, frail, and at-risk individuals, ultimately improving the quality of life for those in need. Overall, the Charitable Mileage Rate Increase Act is a targeted effort to support and expand charitable meal delivery programs, ultimately benefiting both volunteers and the individuals they serve.

Currently, individuals who volunteer to deliver meals to those in need can deduct a certain amount per mile driven from their taxes as a charitable contribution. This bill proposes to increase that standard mileage rate, making it more financially beneficial for volunteers to participate in meal delivery programs.

The goal of this legislation is to incentivize more individuals to volunteer their time and resources to help those who are most vulnerable in our communities. By increasing the standard charitable mileage rate, lawmakers hope to encourage more people to get involved in delivering meals to elderly, disabled, frail, and at-risk individuals, ultimately improving the quality of life for those in need. Overall, the Charitable Mileage Rate Increase Act is a targeted effort to support and expand charitable meal delivery programs, ultimately benefiting both volunteers and the individuals they serve.

Read the Full Bill

Current Status of Bill S 895

Bill S 895 is currently in the status of Bill Introduced since March 6, 2025. Bill S 895 was introduced during Congress 119 and was introduced to the Senate on March 6, 2025. Bill S 895's most recent activity was Read twice and referred to the Committee on Finance. as of March 6, 2025

Bipartisan Support of Bill S 895

Total Number of Sponsors

2Democrat Sponsors

0Republican Sponsors

0Unaffiliated Sponsors

2Total Number of Cosponsors

1Democrat Cosponsors

0Republican Cosponsors

1Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 895

Primary Policy Focus

Alternate Title(s) of Bill S 895

A bill to amend the Internal Revenue Code of 1986 to increase the standard charitable mileage rate for delivery of meals to elderly, disabled, frail, and at-risk individuals.

A bill to amend the Internal Revenue Code of 1986 to increase the standard charitable mileage rate for delivery of meals to elderly, disabled, frail, and at-risk individuals.

Comments

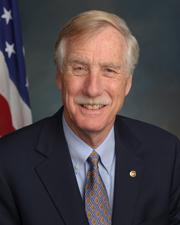

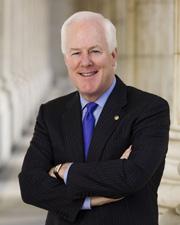

Sponsors and Cosponsors of S 895

Latest Bills

National Defense Authorization Act for Fiscal Year 2026

Bill S 1071December 13, 2025

Enduring Justice for Victims of Trafficking Act

Bill S 2584December 13, 2025

Technical Corrections to the Northwestern New Mexico Rural Water Projects Act, Taos Pueblo Indian Water Rights Settlement Act, and Aamodt Litigation Settlement Act

Bill S 640December 13, 2025

Incentivizing New Ventures and Economic Strength Through Capital Formation Act of 2025

Bill HR 3383December 13, 2025

BOWOW Act of 2025

Bill HR 4638December 13, 2025

Northern Mariana Islands Small Business Access Act

Bill HR 3496December 13, 2025

Wildfire Risk Evaluation Act

Bill HR 3924December 13, 2025

Energy Choice Act

Bill HR 3699December 13, 2025

ESTUARIES Act

Bill HR 3962December 13, 2025

Improving Interagency Coordination for Pipeline Reviews Act

Bill HR 3668December 13, 2025