11

18

18

Tackling Predatory Litigation Funding Act

6/17/2025, 9:06 PM

Summary of Bill S 1821

This bill, designated as S. 1821 in the 119th Congress and introduced on May 20, 2025, aims to amend the Internal Revenue Code of 1986. The bill proposes to establish a tax on income derived from litigation that is received by third-party entities offering financial support for such litigation.

Read the Full Bill

Current Status of Bill S 1821

Bill S 1821 is currently in the status of Bill Introduced since May 20, 2025. Bill S 1821 was introduced during Congress 119 and was introduced to the Senate on May 20, 2025. Bill S 1821's most recent activity was Read twice and referred to the Committee on Finance. as of May 20, 2025

Bipartisan Support of Bill S 1821

Total Number of Sponsors

10Democrat Sponsors

0Republican Sponsors

10Unaffiliated Sponsors

0Total Number of Cosponsors

8Democrat Cosponsors

0Republican Cosponsors

8Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 1821

Primary Policy Focus

TaxationAlternate Title(s) of Bill S 1821

A bill to amend the Internal Revenue Code of 1986 to establish a tax on income from litigation which is received by third-party entities that provided financing for such litigation.

A bill to amend the Internal Revenue Code of 1986 to establish a tax on income from litigation which is received by third-party entities that provided financing for such litigation.

Comments

Bridger Brady

593

8 months ago

This bill is so dumb, like why do they wanna tax money from lawsuits? It's just gonna make things harder for everyone. SMH.

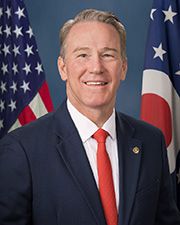

Sponsors and Cosponsors of S 1821

Latest Bills

DIGITAL Applications Act

Bill HR 1665February 23, 2026

ACERO Act

Bill HR 390February 22, 2026

ASCEND Act

Bill HR 2600February 21, 2026

Small Business Artificial Intelligence Advancement Act

Bill HR 3679February 21, 2026

Home School Graduation Recognition Act

Bill HR 6392February 21, 2026

PIPELINE Safety Act of 2025

Bill S 2975February 21, 2026

CHEERS Act of 2026

Bill HR 7620February 21, 2026

Powering Productivity Act

Bill HR 7606February 21, 2026

Rural Water Security Act

Bill HR 7631February 21, 2026

For the relief of Roberto Carlos Lopez.

Bill HR 7639February 21, 2026

Tackling Predatory Litigation Funding Act

Bill HR 3512June 17, 2025