0

0

0

A bill to amend the Internal Revenue Code of 1986 to extend the credit for health insurance costs of eligible individuals.

12/30/2022, 3:34 AM

Congressional Summary of S 3413

This bill extends through 2025 the tax credit for the health insurance costs of individual taxpayers and their family members.

Read the Full Bill

Current Status of Bill S 3413

Bill S 3413 is currently in the status of Bill Introduced since December 16, 2021. Bill S 3413 was introduced during Congress 117 and was introduced to the Senate on December 16, 2021. Bill S 3413's most recent activity was Read twice and referred to the Committee on Finance. as of December 16, 2021

Bipartisan Support of Bill S 3413

Total Number of Sponsors

1Democrat Sponsors

1Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

1Democrat Cosponsors

0Republican Cosponsors

1Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 3413

Primary Policy Focus

TaxationAlternate Title(s) of Bill S 3413

A bill to amend the Internal Revenue Code of 1986 to extend the credit for health insurance costs of eligible individuals.

A bill to amend the Internal Revenue Code of 1986 to extend the credit for health insurance costs of eligible individuals.

Comments

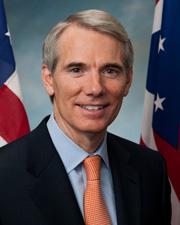

Sponsors and Cosponsors of S 3413

Latest Bills

Pilot Certificate Accessibility Act

Bill HR 2247February 19, 2026

Failing Bank Acquisition Fairness Act

Bill HR 6556February 19, 2026

American Shores Protection Act of 2025

Bill S 3082February 19, 2026

To amend the National Quantum Initiative Act to require a biennial report on the progress of the Subcommittee on Quantum Information Science of the National Science and Technology Council in implementing the national workforce strategic plan, and for other purposes.

Bill HR 7292February 19, 2026

Fundamental Immigration Fairness Act

Bill HR 7456February 19, 2026

EXILE Act

Bill HR 7451February 19, 2026

Uniform Standards for Federal Law Enforcement Act of 2026

Bill HR 7439February 19, 2026

National Bridge Funding Reform Act

Bill HR 7442February 19, 2026

PREVENT DIABETES Act

Bill S 3692February 19, 2026

Preserving Integrity in Immigration Benefits Act

Bill HR 6978February 19, 2026

A bill to amend the Internal Revenue Code of 1986 to permanently extend the Health Coverage Tax Credit.

Bill S 3393December 30, 2022