0

0

0

Taxpayer Bill of Rights Act of 2015

1/11/2023, 1:27 PM

Congressional Summary of S 943

Taxpayer Bill of Rights Act of 2015

Amends the Internal Revenue Code to require the Internal Revenue Service (IRS) to ensure that IRS employees are familiar with and act in accord with taxpayer rights, including the right to be informed, to quality service, to pay no more than the correct amount of tax, to challenge the position of IRS and to be heard, to appeal an IRS decision to an independent forum, to finality, to privacy, to confidentiality, to retain representation, and to a fair and just tax system.

Read the Full Bill

Current Status of Bill S 943

Bill S 943 is currently in the status of Bill Introduced since April 15, 2015. Bill S 943 was introduced during Congress 114 and was introduced to the Senate on April 15, 2015. Bill S 943's most recent activity was Read twice and referred to the Committee on Finance. as of April 15, 2015

Bipartisan Support of Bill S 943

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

0Democrat Cosponsors

0Republican Cosponsors

0Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 943

Primary Policy Focus

TaxationPotential Impact Areas

- Administrative remedies

- Department of the Treasury

- Government employee pay, benefits, personnel management

- Government ethics and transparency, public corruption

- Internal Revenue Service (IRS)

- Lawyers and legal services

- Right of privacy

- Tax administration and collection, taxpayers

Alternate Title(s) of Bill S 943

Taxpayer Bill of Rights Act of 2015

A bill to amend the Internal Revenue Code of 1986 to clarify that a duty of the Commissioner of Internal Revenue is to ensure that Internal Revenue Service employees are familiar with and act in accord with certain taxpayer rights.

Taxpayer Bill of Rights Act of 2015

Comments

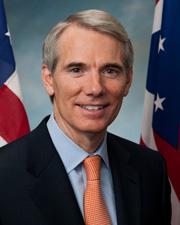

Sponsors and Cosponsors of S 943

Latest Bills

Disaster Zone Energy Affordability and Investment Act

Bill HR 7450March 7, 2026

Protecting Privacy in Purchases Act

Bill HR 1181March 7, 2026

American FIRST Act of 2025

Bill HR 6550March 7, 2026

REVIEW Act of 2025

Bill HR 6544March 7, 2026

SAVES Act of 2025

Bill S 1441March 7, 2026

A joint resolution providing congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Office of the Comptroller of the Currency relating to "Rescission of Principles for Climate-Related Financial Risk Management for Large Financial Institutions".

Bill SJRES 113March 7, 2026

Geothermal Cost-Recovery Authority Act of 2025

Bill HR 398March 7, 2026

Geothermal Royalty Reform Act

Bill HR 5638March 7, 2026

Enhancing Geothermal Production on Federal Lands Act

Bill HR 5576March 7, 2026

Iowa National Guard Heroes Commemoration Act

Bill HR 7511March 7, 2026

Taxpayer Bill of Rights Act of 2015

Bill S 951January 11, 2023

Taxpayer Rights Act of 2015

Bill S 2333January 11, 2023

Taxpayer Bill of Rights Enhancement Act of 2015

Bill S 1578January 11, 2023

Taxpayer Rights Act of 2015

Bill HR 4128January 11, 2023

Consolidated Appropriations Act, 2016

Bill HR 2029April 5, 2023

Taxpayer Bill of Rights Act of 2015

Bill HR 1058January 11, 2023