12

12

12

Resilient Tire Supply and Jobs Act

9/29/2025, 12:48 PM

Summary of Bill S 2790

The bill "A bill to amend the Internal Revenue Code of 1986 to establish the retreaded tire credit, to require Federal agencies to consider the use of retreaded tires, and for other purposes" was introduced in the 119th Congress on September 11, 2025.

Read the Full Bill

Current Status of Bill S 2790

Bill S 2790 is currently in the status of Bill Introduced since September 11, 2025. Bill S 2790 was introduced during Congress 119 and was introduced to the Senate on September 11, 2025. Bill S 2790's most recent activity was Read twice and referred to the Committee on Finance. as of September 11, 2025

Bipartisan Support of Bill S 2790

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

1Democrat Cosponsors

0Republican Cosponsors

1Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 2790

Primary Policy Focus

TaxationAlternate Title(s) of Bill S 2790

A bill to amend the Internal Revenue Code of 1986 to establish the retreaded tire credit, to require Federal agencies to consider the use of retreaded tires, and for other purposes.

A bill to amend the Internal Revenue Code of 1986 to establish the retreaded tire credit, to require Federal agencies to consider the use of retreaded tires, and for other purposes.

Comments

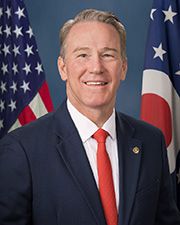

Sponsors and Cosponsors of S 2790

Latest Bills

AI for Secure Networks Act

Bill HR 7294February 18, 2026

Community Health Workforce Development Act

Bill HR 7289February 18, 2026

Connecting Communities Through Transit Planning Act of 2026

Bill HR 7298February 18, 2026

To amend the National Quantum Initiative Act to require a biennial report on the progress of the Subcommittee on Quantum Information Science of the National Science and Technology Council in implementing the national workforce strategic plan, and for other purposes.

Bill HR 7292February 18, 2026

To direct the Secretary of Health and Human Services, acting through the Commissioner of Food and Drugs, to establish a board to review certain designations that a substance used in food is generally recognized as safe, with respect to the intended use of such substance, and for other purposes.

Bill HR 7291February 18, 2026

I&A Mission Reorientation Act of 2026

Bill HR 7443February 18, 2026

Domestic ORE Act

Bill HR 7458February 18, 2026

CLEAN Act

Bill HR 7453February 18, 2026

USMCA Travel and Tourism Resiliency Act

Bill HR 7454February 18, 2026

Fundamental Immigration Fairness Act

Bill HR 7456February 18, 2026

Retreaded Tire Jobs, Supply Chain Security and Sustainability Act of 2025

Bill HR 3401June 6, 2025