2

7

7

Federal Disaster Tax Relief Act of 2025

9/22/2025, 4:32 PM

Summary of Bill S 2744

The bill introduced in the 119th Congress with the title "A bill to amend the Internal Revenue Code of 1986 to codify and extend the rules for personal casualty losses arising from major disasters and the rules for the exclusion from gross income of compensation for losses or damages resulting from certain wildfires" aims to make amendments to the Internal Revenue Code related to personal casualty losses from major disasters and the exclusion of income for losses or damages caused by specific wildfires.

Read the Full Bill

Current Status of Bill S 2744

Bill S 2744 is currently in the status of Bill Introduced since September 9, 2025. Bill S 2744 was introduced during Congress 119 and was introduced to the Senate on September 9, 2025. Bill S 2744's most recent activity was Read twice and referred to the Committee on Finance. as of September 9, 2025

Bipartisan Support of Bill S 2744

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

1Democrat Cosponsors

1Republican Cosponsors

0Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 2744

Primary Policy Focus

TaxationAlternate Title(s) of Bill S 2744

A bill to amend the Internal Revenue Code of 1986 to codify and extend the rules for personal casualty losses arising from major disasters and the rules for the exclusion from gross income of compensation for losses or damages resulting from certain wildfires.

A bill to amend the Internal Revenue Code of 1986 to codify and extend the rules for personal casualty losses arising from major disasters and the rules for the exclusion from gross income of compensation for losses or damages resulting from certain wildfires.

Comments

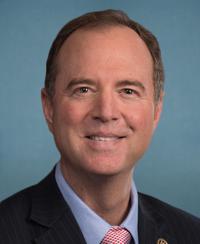

Sponsors and Cosponsors of S 2744

Latest Bills

Children and Teens’ Online Privacy Protection Act

Bill S 836March 6, 2026

Servicemembers’ Credit Monitoring Enhancement Act

Bill S 2074March 6, 2026

Chugach Alaska Land Exchange Oil Spill Recovery Act of 2025

Bill HR 3903March 6, 2026

A bill to amend the Food, Agriculture, Conservation, and Trade Act of 1990 to ensure adequate staffing and resources for the Institute of Tropical Forestry and the Institute of Pacific Islands Forestry.

Bill S 3851March 6, 2026

A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to "Beginning of Construction Requirements for Purposes of the Termination of Clean Electricity Production Credits and Clean Electricity Investment Credits for Applicable Wind and Solar Facilities".

Bill SJRES 107March 6, 2026

A bill to amend title 10, United States Code, to authorize representatives of veterans service organizations to participate in presentations to promote certain benefits available to veterans during preseparation counseling under the Transition Assistance Program of the Department of Defense, and for other purposes.

Bill S 3938March 6, 2026

A bill to provide for the imposition of sanctions with respect to forced organ harvesting within the People's Republic of China, and for other purposes.

Bill S 4009March 6, 2026

A bill to amend title 18, United States Code, to provide that the prohibition on the possession of firearms and ammunition by certain aliens shall apply with respect to the use of firearms and ammunition by government entities.

Bill S 3909March 6, 2026

A joint resolution to direct the removal of United States Armed Forces from hostilities within or against the Islamic Republic of Iran that have not been authorized by Congress.

Bill SJRES 116March 6, 2026

A bill to authorize a grant program for the development and implementation of housing supply and affordability plans, and for other purposes.

Bill S 4020March 6, 2026

Protect Innocent Victims of Taxation After Fire Extension Act

Bill HR 5225September 27, 2025