0

0

0

To amend the Internal Revenue Code of 1986 to provide that certain payments to foreign related parties subject to sufficient foreign tax are not treated as base erosion payments.

3/24/2025, 1:18 PM

Summary of Bill HR 1911

Bill 119 HR 1911, also known as the "Foreign Tax Credit Protection Act," aims to amend the Internal Revenue Code of 1986 in order to clarify that certain payments made to foreign related parties, which are subject to sufficient foreign tax, should not be considered as base erosion payments.

The bill seeks to address concerns regarding the treatment of payments made to foreign related parties for tax purposes. Specifically, it aims to ensure that payments made to foreign related parties that are subject to an adequate amount of foreign tax are not unfairly penalized or categorized as base erosion payments.

By making this amendment to the Internal Revenue Code, the bill aims to provide clarity and certainty for taxpayers engaging in transactions with foreign related parties. This clarification is intended to prevent unintended consequences and ensure that taxpayers are not unfairly penalized for engaging in legitimate business transactions. Overall, the Foreign Tax Credit Protection Act seeks to promote fairness and transparency in the tax treatment of payments made to foreign related parties, while also providing certainty for taxpayers and reducing the risk of base erosion.

The bill seeks to address concerns regarding the treatment of payments made to foreign related parties for tax purposes. Specifically, it aims to ensure that payments made to foreign related parties that are subject to an adequate amount of foreign tax are not unfairly penalized or categorized as base erosion payments.

By making this amendment to the Internal Revenue Code, the bill aims to provide clarity and certainty for taxpayers engaging in transactions with foreign related parties. This clarification is intended to prevent unintended consequences and ensure that taxpayers are not unfairly penalized for engaging in legitimate business transactions. Overall, the Foreign Tax Credit Protection Act seeks to promote fairness and transparency in the tax treatment of payments made to foreign related parties, while also providing certainty for taxpayers and reducing the risk of base erosion.

Read the Full Bill

Current Status of Bill HR 1911

Bill HR 1911 is currently in the status of Bill Introduced since March 6, 2025. Bill HR 1911 was introduced during Congress 119 and was introduced to the House on March 6, 2025. Bill HR 1911's most recent activity was Referred to the House Committee on Ways and Means. as of March 6, 2025

Bipartisan Support of Bill HR 1911

Total Number of Sponsors

2Democrat Sponsors

2Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

2Democrat Cosponsors

1Republican Cosponsors

1Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill HR 1911

Primary Policy Focus

Alternate Title(s) of Bill HR 1911

To amend the Internal Revenue Code of 1986 to provide that certain payments to foreign related parties subject to sufficient foreign tax are not treated as base erosion payments.

To amend the Internal Revenue Code of 1986 to provide that certain payments to foreign related parties subject to sufficient foreign tax are not treated as base erosion payments.

Comments

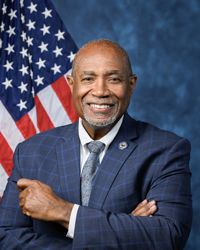

Sponsors and Cosponsors of HR 1911

Latest Bills

Native American Entrepreneurial Opportunity Act

Bill HR 7396February 26, 2026

Cross-Boundary Wildfire Solutions Act

Bill HR 3922February 26, 2026

Territorial Student Access to Higher Education Act

Bill HR 6472February 26, 2026

Enhancing Detection of Human Trafficking Act

Bill HR 4307February 26, 2026

Home School Graduation Recognition Act

Bill HR 6392February 26, 2026

Rail and Highway Transmission Planning Act

Bill HR 7405February 26, 2026

First Responder Network Authority Reauthorization Act of 2026

Bill HR 7386February 26, 2026

Older Workers’ Bureau Act

Bill HR 7524February 26, 2026

Improving Reporting to Prevent Hate Act of 2026

Bill S 3724February 26, 2026

REAL Health Providers Act

Bill S 3750February 26, 2026