0

0

0

A bill to amend the Internal Revenue Code of 1986 to terminate the tax-exempt status of terrorist supporting organizations.

5/2/2024, 1:14 PM

Summary of Bill S 4136

Bill 118 s 4136, also known as the "Termination of Tax-Exempt Status for Terrorist Supporting Organizations Act," aims to make changes to the Internal Revenue Code of 1986. The main goal of this bill is to end the tax-exempt status of organizations that support or fund terrorist activities.

If this bill is passed, organizations that are found to be supporting terrorism will no longer be eligible for tax-exempt status. This means that they will have to pay taxes on any income they receive, just like any other business or individual.

The bill is designed to crack down on terrorist financing and make it more difficult for these organizations to operate and carry out their harmful activities. By removing their tax-exempt status, the hope is that it will help disrupt their funding sources and hinder their ability to carry out attacks. Overall, the Termination of Tax-Exempt Status for Terrorist Supporting Organizations Act is a measure aimed at increasing national security and preventing the flow of funds to terrorist groups. It is a step towards holding these organizations accountable for their actions and cutting off their financial support.

If this bill is passed, organizations that are found to be supporting terrorism will no longer be eligible for tax-exempt status. This means that they will have to pay taxes on any income they receive, just like any other business or individual.

The bill is designed to crack down on terrorist financing and make it more difficult for these organizations to operate and carry out their harmful activities. By removing their tax-exempt status, the hope is that it will help disrupt their funding sources and hinder their ability to carry out attacks. Overall, the Termination of Tax-Exempt Status for Terrorist Supporting Organizations Act is a measure aimed at increasing national security and preventing the flow of funds to terrorist groups. It is a step towards holding these organizations accountable for their actions and cutting off their financial support.

Read the Full Bill

Current Status of Bill S 4136

Bill S 4136 is currently in the status of Bill Introduced since April 17, 2024. Bill S 4136 was introduced during Congress 118 and was introduced to the Senate on April 17, 2024. Bill S 4136's most recent activity was Read twice and referred to the Committee on Finance. as of April 17, 2024

Bipartisan Support of Bill S 4136

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

2Democrat Cosponsors

0Republican Cosponsors

0Unaffiliated Cosponsors

2Policy Area and Potential Impact of Bill S 4136

Primary Policy Focus

Alternate Title(s) of Bill S 4136

A bill to amend the Internal Revenue Code of 1986 to terminate the tax-exempt status of terrorist supporting organizations.

A bill to amend the Internal Revenue Code of 1986 to terminate the tax-exempt status of terrorist supporting organizations.

Comments

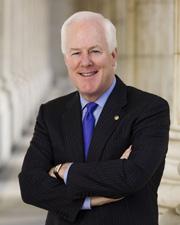

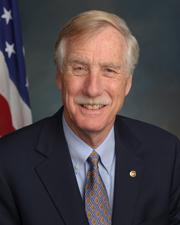

Sponsors and Cosponsors of S 4136

Latest Bills

Venezuela Oil Proceeds Transparency Act

Bill S 3838February 26, 2026

Paving the Way for American Industry Act

Bill S 3819February 26, 2026

TEMP Act

Bill S 3843February 26, 2026

Workforce Development Modernization Act

Bill S 3825February 26, 2026

Financial Disclosure Modernization Act

Bill S 3827February 26, 2026

Virginia's Law

Bill S 3815February 26, 2026

Ensuring Benefits for Disabled Veterans Act

Bill S 3818February 26, 2026

State Authority to Protect Civil Rights

Bill S 3824February 26, 2026

Fiscal Harms of Federal Firing Act

Bill S 3844February 26, 2026

GRID Act

Bill S 3852February 26, 2026

Stop Terror-Financing and Tax Penalties on American Hostages Act

Bill HR 9495December 16, 2024