0

0

0

Water Conservation Rebate Tax Parity Act

12/31/2022, 5:05 AM

Summary of Bill HR 4647

Bill 117 HR 4647, also known as the Water Conservation Rebate Tax Parity Act, is a piece of legislation currently being considered by the US Congress. The main goal of this bill is to promote water conservation by providing tax incentives for individuals and businesses that invest in water-saving technologies.

If passed, the bill would allow taxpayers to claim a tax credit for 30% of the cost of purchasing and installing water conservation equipment, such as low-flow toilets, water-efficient appliances, and rainwater harvesting systems. This tax credit would be capped at $1,500 per taxpayer per year.

The bill also aims to level the playing field for water conservation rebates by ensuring that these rebates are not subject to federal income tax. Currently, some states offer rebates for water-saving investments, but these rebates are often taxed as income, reducing their effectiveness in incentivizing conservation efforts. Supporters of the bill argue that it will help to reduce water usage, lower utility bills, and promote sustainable practices. They also believe that it will stimulate the economy by encouraging investment in water-saving technologies. Opponents of the bill may argue that it could lead to a loss of tax revenue for the government, or that it unfairly benefits certain industries or individuals. However, the bill has bipartisan support and is seen as a positive step towards promoting water conservation in the United States.

If passed, the bill would allow taxpayers to claim a tax credit for 30% of the cost of purchasing and installing water conservation equipment, such as low-flow toilets, water-efficient appliances, and rainwater harvesting systems. This tax credit would be capped at $1,500 per taxpayer per year.

The bill also aims to level the playing field for water conservation rebates by ensuring that these rebates are not subject to federal income tax. Currently, some states offer rebates for water-saving investments, but these rebates are often taxed as income, reducing their effectiveness in incentivizing conservation efforts. Supporters of the bill argue that it will help to reduce water usage, lower utility bills, and promote sustainable practices. They also believe that it will stimulate the economy by encouraging investment in water-saving technologies. Opponents of the bill may argue that it could lead to a loss of tax revenue for the government, or that it unfairly benefits certain industries or individuals. However, the bill has bipartisan support and is seen as a positive step towards promoting water conservation in the United States.

Congressional Summary of HR 4647

Water Conservation Rebate Tax Parity Act

This bill expands the tax exclusions for energy conservation subsidies to include subsidies provided (directly or indirectly) (1) by a public utility for the purchase or installation of any water conservation or efficiency measure; (2) by a storm water management provider for the purchase or installation of any storm water management measure; or (3) by a state or local government to a resident of such state or locality for the purchase or installation of any wastewater management measure, but only if such measure concerns the taxpayer's principal residence.

Read the Full Bill

Current Status of Bill HR 4647

Bill HR 4647 is currently in the status of Bill Introduced since July 22, 2021. Bill HR 4647 was introduced during Congress 117 and was introduced to the House on July 22, 2021. Bill HR 4647's most recent activity was Referred to the House Committee on Ways and Means. as of July 22, 2021

Bipartisan Support of Bill HR 4647

Total Number of Sponsors

1Democrat Sponsors

1Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

44Democrat Cosponsors

44Republican Cosponsors

0Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill HR 4647

Primary Policy Focus

TaxationAlternate Title(s) of Bill HR 4647

To amend the Internal Revenue Code of 1986 to expand the exclusion for certain conservation subsidies to include subsidies for water conservation or efficiency measures and storm water management measures.

Water Conservation Rebate Tax Parity Act

Water Conservation Rebate Tax Parity Act

Comments

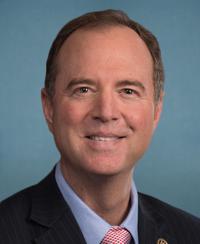

Sponsors and Cosponsors of HR 4647

Latest Bills

ARCA Act of 2025

Bill S 1591December 12, 2025

Ensuring VetSuccess On Campus Act of 2025

Bill S 610December 12, 2025

Halting Ownership and Non-Ethical Stock Transactions (HONEST) Act

Bill S 1498December 12, 2025

Electric Supply Chain Act

Bill HR 3638December 12, 2025

National Defense Authorization Act for Fiscal Year 2026

Bill S 1071December 12, 2025

PERMIT Act

Bill HR 3898December 12, 2025

State Planning for Reliability and Affordability Act

Bill HR 3628December 12, 2025

Improving Interagency Coordination for Pipeline Reviews Act

Bill HR 3668December 12, 2025

Increasing Investor Opportunities Act

Bill HR 3383December 12, 2025

Holocaust Expropriated Art Recovery Act of 2025

Bill S 1884December 11, 2025

Water Conservation Rebate Tax Parity Act

Bill S 2430January 1, 2023

GREEN Act of 2021

Bill HR 848January 11, 2023

Water Advanced Technologies for Efficient Resource Use Act of 2021

Bill HR 5438December 31, 2022

Inflation Reduction Act of 2022

Bill HR 5376September 5, 2023

FUTURE Western Water Infrastructure and Drought Resiliency Act

Bill HR 3404March 9, 2023