0

0

0

A bill to amend the Internal Revenue Code of 1986 to provide for the proper tax treatment of personal service income earned in pass-thru entities.

2/7/2025, 11:56 AM

Summary of Bill S 445

Bill 119 s 445, also known as the "Personal Service Income Tax Treatment Act," aims to make changes to the Internal Revenue Code of 1986 in order to address the tax treatment of personal service income earned in pass-thru entities.

Pass-thru entities, such as partnerships and S corporations, allow income to pass through to the owners and be taxed at their individual tax rates. However, there has been concern that some individuals are using these entities to avoid paying higher taxes on personal service income.

This bill seeks to ensure that personal service income earned through pass-thru entities is taxed appropriately. It aims to prevent individuals from using these entities to lower their tax liability on income that should be considered personal service income. The specifics of how this will be achieved are not detailed in the summary of the bill. However, it is clear that the goal is to close any loopholes that may exist in the current tax code and ensure that individuals are paying their fair share of taxes on personal service income. Overall, Bill 119 s 445 is focused on addressing potential tax avoidance strategies related to personal service income earned in pass-thru entities and ensuring that individuals are paying the appropriate amount of taxes on this income.

Pass-thru entities, such as partnerships and S corporations, allow income to pass through to the owners and be taxed at their individual tax rates. However, there has been concern that some individuals are using these entities to avoid paying higher taxes on personal service income.

This bill seeks to ensure that personal service income earned through pass-thru entities is taxed appropriately. It aims to prevent individuals from using these entities to lower their tax liability on income that should be considered personal service income. The specifics of how this will be achieved are not detailed in the summary of the bill. However, it is clear that the goal is to close any loopholes that may exist in the current tax code and ensure that individuals are paying their fair share of taxes on personal service income. Overall, Bill 119 s 445 is focused on addressing potential tax avoidance strategies related to personal service income earned in pass-thru entities and ensuring that individuals are paying the appropriate amount of taxes on this income.

Current Status of Bill S 445

Bill S 445 is currently in the status of Bill Introduced since February 6, 2025. Bill S 445 was introduced during Congress 119 and was introduced to the Senate on February 6, 2025. Bill S 445's most recent activity was Read twice and referred to the Committee on Finance. as of February 6, 2025

Bipartisan Support of Bill S 445

Total Number of Sponsors

1Democrat Sponsors

1Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

13Democrat Cosponsors

12Republican Cosponsors

0Unaffiliated Cosponsors

1Policy Area and Potential Impact of Bill S 445

Primary Policy Focus

Alternate Title(s) of Bill S 445

A bill to amend the Internal Revenue Code of 1986 to provide for the proper tax treatment of personal service income earned in pass-thru entities.

A bill to amend the Internal Revenue Code of 1986 to provide for the proper tax treatment of personal service income earned in pass-thru entities.

Comments

Leonidas Hansen

406

10 months ago

This bill gonna mess up my taxes! It gonna make me pay more money to the government. I don't like it one bit. Short term, it gonna hurt my wallet for sure.

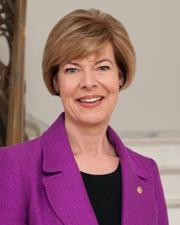

Sponsors and Cosponsors of S 445

Latest Bills

Dismissing the election contest relating to the office of Representative from the Twenty-eighth Congressional District of Texas.

Bill HRES 309December 12, 2025

Dismissing the election contest relating to the office of Representative from the Fourteenth Congressional District of Florida.

Bill HRES 308December 12, 2025

Dismissing the election contest relating to the office of Representative from the Thirtieth Congressional District of Texas.

Bill HRES 311December 12, 2025

Dismissing the election contest relating to the office of Representative from the Fourteenth Congressional District of Florida.

Bill HRES 312December 12, 2025

Dismissing the election contest relating to the office of Representative from the at-large Congressional District of Alaska.

Bill HRES 310December 12, 2025

Snow Water Supply Forecasting Reauthorization Act of 2025

Bill HR 3857December 12, 2025

ARCA Act of 2025

Bill S 1591December 12, 2025

Ensuring VetSuccess On Campus Act of 2025

Bill S 610December 12, 2025

Halting Ownership and Non-Ethical Stock Transactions (HONEST) Act

Bill S 1498December 12, 2025

Electric Supply Chain Act

Bill HR 3638December 12, 2025