0

0

0

Economic Security and Worker Assistance Act of 2002

1/16/2023, 11:18 PM

Congressional Summary of HR 622

Hope for Children Act - Amends the Internal Revenue Code to increase the expenses allowable towards the adoption credit.

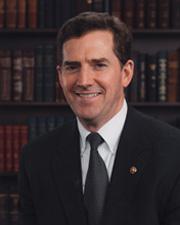

Renames such credit as the "Tom Bliley adoption credit."

Read the Full Bill

Current Status of Bill HR 622

Bill HR 622 is currently in the status of Bill Introduced since February 14, 2001. Bill HR 622 was introduced during Congress 107 and was introduced to the House on February 14, 2001. Bill HR 622's most recent activity was Message on House action received in Senate and at desk: House amendments to Senate amendments. as of March 6, 2002

Bipartisan Support of Bill HR 622

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

250Democrat Cosponsors

78Republican Cosponsors

170Unaffiliated Cosponsors

2Policy Area and Potential Impact of Bill HR 622

Primary Policy Focus

TaxationPotential Impact Areas

- Accounting

- Adopted children

- Adoption

- Adoptive parents

- Agriculture and Food

- Aid to dependent children

- Alcohol tax

- Alcoholic beverages

- Alternative energy sources

- Alternative fuels

- Appropriations

- Architecture

- Arts, Culture, Religion

- Biomass energy

- Books

- Building construction

- Business income tax

- Business losses

- Cash welfare block grants

- Civil Rights and Liberties, Minority Issues

- Commemorations

- Commerce

- Computer software

- Computer-assisted instruction

- Computers in education

- Congress

- Congressional tributes

- Construction costs

- Consultants

- Corporate debt

- Corporation taxes

- Cost of living adjustments

- Costs

- Day care

- Depletion allowances

- Depreciation and amortization

- Diesel motor

- Disabled

- Disabled children

- Discrimination in insurance

- Discrimination in medical care

- Dislocated workers

- EBB Terrorism

- Economics and Public Finance

- Education

- Electric power production

- Electric vehicles

- Electronic data interchange

- Electronic government information

- Elementary and secondary education

- Elementary schools

- Employee benefit plans

- Employee health benefits

- Employment tax credits

- Energy

- Environmental Protection

- Ex-Members of Congress

- Families

- Farm manure

- Federal aid to child health services

- Federal-state relations

- Finance and Financial Sector

- Foreign tax credit

- Foster home care

- Gas industry

- Government Operations and Politics

- Government paperwork

- Government trust funds

- Grants-in-aid

- Health

- Health insurance

- Housing and Community Development

- Hydrogen as fuel

- Income

- Income tax

- Indexing (Economic policy)

- Indian economic development

- Infrastructure

- Insurance companies

- Insurance premiums

- Insurance rates

- International Affairs

- Labor and Employment

- Leases

- Life insurance

- Liquefied natural gas

- Liquefied petroleum gas

- Medical economics

- Medical savings accounts

- Medically uninsured

- Members of Congress (House)

- Mental health services

- Minimum tax

- Minorities

- Minority employment

- Names

- Natural gas vehicles

- New York City

- Office buildings

- Oil well drilling

- Pension trust guaranty insurance

- Performing arts

- Personal income tax

- Petroleum industry

- Poor children

- Population growth

- Poultry industry

- Public utilities

- Refuse as fuel

- School buildings

- Science, Technology, Communications

- Secondary education

- September 11, 2001

- Service stations

- Small business

- Social Welfare

- Stockholders

- Stocks

- Tax credits

- Tax cuts

- Tax deductions

- Tax exclusion

- Tax rates

- Tax rebates

- Tax refunds

- Tax returns

- Tax-exempt securities

- Teachers

- Teaching materials

- Terrorism

- Textbooks

- Transportation and Public Works

- Unemployment insurance

- Virginia

- Water Resources Development

- Water supply

- Welfare-to-work

- Wind power

Alternate Title(s) of Bill HR 622

Economic Security and Worker Assistance Act of 2002

To amend the Internal Revenue Code of 1986 to expand the adoption credit, and for other purposes.

Economic Security and Worker Assistance Act of 2002

Temporary Extended Unemployment Compensation Act of 2002

Adoption Tax Credit bill

Hope for Children Act

Hope for Children Act

Hope for Children Act

Comments

Sponsors and Cosponsors of HR 622

Latest Bills

Supporting the goals and ideals of "Career and Technical Education Month".

Bill HRES 1063February 18, 2026

Historic Infrastructure Management and Jobs Training Act

Bill HR 7179February 18, 2026

Methane Monitoring Science Act of 2026

Bill HR 7416February 18, 2026

Daylight Act of 2026

Bill HR 7378February 18, 2026

Ensuring Access to Medicaid Buy-in Programs Act of 2026

Bill S 3690February 18, 2026

Artificial Intelligence Public Awareness and Education Campaign Act

Bill HR 7151February 18, 2026

Housing Without Fear Act of 2026

Bill HR 7374February 18, 2026

American Family Housing Act

Bill HR 7186February 18, 2026

Yes in God's Backyard Act

Bill HR 7152February 18, 2026

Expanding AI Voices Act

Bill HR 7158February 18, 2026

Providing for consideration of the Senate amendments to the bill (H.R. 622) to amend the Internal Revenue Code of 1986 to expand the adoption credit, and for other purposes.

Bill HRES 347January 16, 2023

Providing for consideration of the bill (H.R. 622) to amend the Internal Revenue Code of 1986 to expand the adoption credit, and for other purposes.

Bill HRES 141January 16, 2023

Economic Growth and Tax Relief Reconciliation Act of 2001

Bill HR 1836January 16, 2023