7

11

11

Military Spouse Hiring Act

4/11/2025, 11:03 AM

Summary of Bill S 1027

Bill 119 s 1027, also known as the Military Spouses Employment Act, aims to amend the Internal Revenue Code of 1986 to allow employers of spouses of military personnel to be eligible for the work opportunity credit. This credit is designed to incentivize businesses to hire individuals from certain targeted groups, including veterans and individuals receiving government assistance.

The bill recognizes the unique challenges faced by military spouses, who often have to relocate frequently due to their partner's service obligations. This can make it difficult for them to find and maintain employment. By extending the work opportunity credit to employers who hire military spouses, the bill seeks to support these individuals and their families.

If passed, this legislation would provide a financial incentive for businesses to hire military spouses, potentially increasing their employment opportunities and economic stability. This could have a positive impact on the well-being of military families and help to address some of the employment barriers faced by this population. Overall, the Military Spouses Employment Act aims to support military families by providing additional employment opportunities for spouses of service members. It is a bipartisan effort to address the unique challenges faced by this population and promote economic stability within military communities.

The bill recognizes the unique challenges faced by military spouses, who often have to relocate frequently due to their partner's service obligations. This can make it difficult for them to find and maintain employment. By extending the work opportunity credit to employers who hire military spouses, the bill seeks to support these individuals and their families.

If passed, this legislation would provide a financial incentive for businesses to hire military spouses, potentially increasing their employment opportunities and economic stability. This could have a positive impact on the well-being of military families and help to address some of the employment barriers faced by this population. Overall, the Military Spouses Employment Act aims to support military families by providing additional employment opportunities for spouses of service members. It is a bipartisan effort to address the unique challenges faced by this population and promote economic stability within military communities.

Read the Full Bill

Current Status of Bill S 1027

Bill S 1027 is currently in the status of Bill Introduced since March 13, 2025. Bill S 1027 was introduced during Congress 119 and was introduced to the Senate on March 13, 2025. Bill S 1027's most recent activity was Read twice and referred to the Committee on Finance. as of March 13, 2025

Bipartisan Support of Bill S 1027

Total Number of Sponsors

4Democrat Sponsors

4Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

14Democrat Cosponsors

6Republican Cosponsors

8Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 1027

Primary Policy Focus

Alternate Title(s) of Bill S 1027

A bill to amend the Internal Revenue Code of 1986 to make employers of spouses of military personnel eligible for the work opportunity credit.

A bill to amend the Internal Revenue Code of 1986 to make employers of spouses of military personnel eligible for the work opportunity credit.

Comments

Daniela Day

414

8 months ago

This bill is so sad for military spouses like me. It's not fair how it affects us. I wish it wasn't happening.

Teo Erickson

446

8 months ago

I can't believe how long it took for this bill to pass! Finally, military spouses will have more opportunities for employment. This is such a huge win for our community. I know so many spouses who struggle to find jobs every time they move due to their partner's military service. This bill will make a real difference in the lives of so many families. I'm grateful for this progress.

Collin Chu

519

8 months ago

So, what does this bill mean for me as a military spouse in AZ?

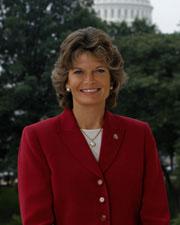

Sponsors and Cosponsors of S 1027

Latest Bills

Providing amounts for the expenses of the Committee on Ethics in the One Hundred Nineteenth Congress.

Bill HRES 131December 12, 2025

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Bureau of Land Management relating to "Central Yukon Record of Decision and Approved Resource Management Plan".

Bill HJRES 106December 12, 2025

Expressing the sense of the House of Representatives in condemning the Government of the People's Republic of China for its harassment and efforts to intimidate American citizens and other individuals on United States soil with the goal of suppressing speech and narratives the People's Republic of China finds unwelcome.

Bill HRES 130December 12, 2025

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Bureau of Land Management relating to "North Dakota Field Office Record of Decision and Approved Resource Management Plan".

Bill HJRES 105December 12, 2025

Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Bureau of Land Management relating to "Miles City Field Office Record of Decision and Approved Resource Management Plan Amendment".

Bill HJRES 104December 12, 2025

Providing amounts for the expenses of the Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party in the One Hundred Nineteenth Congress.

Bill HRES 104December 12, 2025

Critical Access for Veterans Care Act

Bill S 1868December 12, 2025

OATH Act of 2025

Bill S 1665December 12, 2025

A bill to extend the authority for modifications to the Second Division Memorial in the District of Columbia.

Bill S 1353December 12, 2025

Saving Our Veterans Lives Act of 2025

Bill S 926December 12, 2025