0

0

0

A bill to amend the Internal Revenue Code of 1986 to terminate the tax-exempt status of terrorist supporting organizations.

5/2/2024, 1:14 PM

Summary of Bill S 4136

Bill 118 s 4136, also known as the "Termination of Tax-Exempt Status for Terrorist Supporting Organizations Act," aims to make changes to the Internal Revenue Code of 1986. The main goal of this bill is to end the tax-exempt status of organizations that support or fund terrorist activities.

If this bill is passed, organizations that are found to be supporting terrorism will no longer be eligible for tax-exempt status. This means that they will have to pay taxes on any income they receive, just like any other business or individual.

The bill is designed to crack down on terrorist financing and make it more difficult for these organizations to operate and carry out their harmful activities. By removing their tax-exempt status, the hope is that it will help disrupt their funding sources and hinder their ability to carry out attacks. Overall, the Termination of Tax-Exempt Status for Terrorist Supporting Organizations Act is a measure aimed at increasing national security and preventing the flow of funds to terrorist groups. It is a step towards holding these organizations accountable for their actions and cutting off their financial support.

If this bill is passed, organizations that are found to be supporting terrorism will no longer be eligible for tax-exempt status. This means that they will have to pay taxes on any income they receive, just like any other business or individual.

The bill is designed to crack down on terrorist financing and make it more difficult for these organizations to operate and carry out their harmful activities. By removing their tax-exempt status, the hope is that it will help disrupt their funding sources and hinder their ability to carry out attacks. Overall, the Termination of Tax-Exempt Status for Terrorist Supporting Organizations Act is a measure aimed at increasing national security and preventing the flow of funds to terrorist groups. It is a step towards holding these organizations accountable for their actions and cutting off their financial support.

Read the Full Bill

Current Status of Bill S 4136

Bill S 4136 is currently in the status of Bill Introduced since April 17, 2024. Bill S 4136 was introduced during Congress 118 and was introduced to the Senate on April 17, 2024. Bill S 4136's most recent activity was Read twice and referred to the Committee on Finance. as of April 17, 2024

Bipartisan Support of Bill S 4136

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

2Democrat Cosponsors

0Republican Cosponsors

0Unaffiliated Cosponsors

2Policy Area and Potential Impact of Bill S 4136

Primary Policy Focus

Alternate Title(s) of Bill S 4136

A bill to amend the Internal Revenue Code of 1986 to terminate the tax-exempt status of terrorist supporting organizations.

A bill to amend the Internal Revenue Code of 1986 to terminate the tax-exempt status of terrorist supporting organizations.

Comments

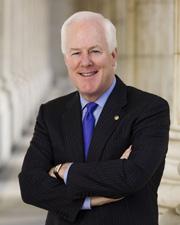

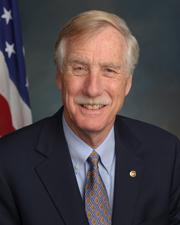

Sponsors and Cosponsors of S 4136

Latest Bills

Holocaust Expropriated Art Recovery Act of 2025

Bill S 1884December 12, 2025

Enduring Justice for Victims of Trafficking Act

Bill S 2584December 12, 2025

Increasing Investor Opportunities Act

Bill HR 3383December 12, 2025

Great Lakes Fishery Research Reauthorization Act

Bill S 2878December 12, 2025

Electric Supply Chain Act

Bill HR 3638December 12, 2025

State Planning for Reliability and Affordability Act

Bill HR 3628December 12, 2025

A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Office of the Secretary of the Department of Health and Human Services relating to "Policy on Adhering to the Text of the Administrative Procedure Act".

Bill SJRES 82December 12, 2025

Providing for consideration of the bill (H.R. 2550) to nullify the Executive Order relating to Exclusions from Federal Labor-Management Relations Programs, and for other purposes.

Bill HRES 432December 12, 2025

Mining Regulatory Clarity Act

Bill HR 1366December 12, 2025

Legacy Mine Cleanup Act of 2025

Bill S 2741December 12, 2025

Stop Terror-Financing and Tax Penalties on American Hostages Act

Bill HR 9495December 16, 2024