0

0

0

International Competition for American Jobs Act

5/10/2023, 3:45 AM

Congressional Summary of S 5349

International Competition for American Jobs Act

This bill modifies provisions relating to the taxation of foreign entities.

Among other provisions, the bill

- makes permanent the look-thru rule for controlled foreign corporations (CFCs). (A look-thru rule provides that dividends, interest, rents and royalties that one CFC receives or accrues from a related CFC are not treated as foreign personal holding company income);

- modifies the tax deduction for foreign-derived intangible income and global intangible low-taxed income;

- modifies the base erosion minimum tax (10% minimum tax imposed to prevent corporations operating in the United States from avoiding tax liability by shifting profits out of the United States);

- modifies tax rules allocating certain tax deductions for purposes of the foreign tax credit limitation;

- restores the limitation on the attribution of stock ownership for purposes of applying constructive ownership rules; and

- includes specified amounts in the gross income of CFC shareholders.

Read the Full Bill

Current Status of Bill S 5349

Bill S 5349 is currently in the status of Bill Introduced since December 21, 2022. Bill S 5349 was introduced during Congress 117 and was introduced to the Senate on December 21, 2022. Bill S 5349's most recent activity was Read twice and referred to the Committee on Finance. as of December 21, 2022

Bipartisan Support of Bill S 5349

Total Number of Sponsors

1Democrat Sponsors

0Republican Sponsors

1Unaffiliated Sponsors

0Total Number of Cosponsors

0Democrat Cosponsors

0Republican Cosponsors

0Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill S 5349

Primary Policy Focus

TaxationAlternate Title(s) of Bill S 5349

International Competition for American Jobs Act

International Competition for American Jobs Act

A bill to amend the Internal Revenue Code of 1986 to modify certain provisions relating to the taxation of international entities.

Comments

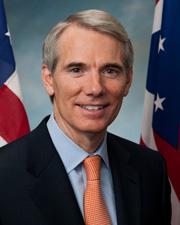

Sponsors and Cosponsors of S 5349

Latest Bills

Enduring Justice for Victims of Trafficking Act

Bill S 2584December 12, 2025

A bill to amend the Alaska Native Claims Settlement Act to provide that Alexander Creek, Incorporated, is recognized as a Village Corporation under that Act, and for other purposes.

Bill S 1468December 12, 2025

Ensuring VetSuccess On Campus Act of 2025

Bill S 610December 12, 2025

Technical Corrections to the Northwestern New Mexico Rural Water Projects Act, Taos Pueblo Indian Water Rights Settlement Act, and Aamodt Litigation Settlement Act

Bill S 640December 12, 2025

Keweenaw Bay Indian Community Land Claim Settlement Act of 2025

Bill S 642December 12, 2025

ARCA Act of 2025

Bill S 1591December 12, 2025

Disaster Related Extension of Deadlines Act

Bill HR 1491December 12, 2025

Billion Dollar Boondoggle Act of 2025

Bill S 766December 12, 2025

PORCUPINE Act

Bill S 1744December 12, 2025

Miccosukee Reserved Area Amendments Act

Bill HR 504December 12, 2025

Inflation Reduction Act of 2022

Bill HR 5376September 5, 2023

To amend the Internal Revenue Code of 1986 to restore the limitation on downward attribution of stock ownership in applying the constructive ownership rules to controlled foreign corporations, and for other purposes.

Bill HR 2847February 14, 2023