0

0

0

To amend the Internal Revenue Code of 1986 to exempt certain late unemployment payments from taxation.

12/29/2022, 10:18 PM

Summary of Bill HR 7350

Bill 117 HR 7350, also known as the "Unemployment Tax Relief Act," aims to make changes to the Internal Revenue Code of 1986 in order to provide tax relief for individuals who have received late unemployment payments. The bill specifically targets those who have experienced delays in receiving their unemployment benefits due to administrative issues or other factors beyond their control.

Under the proposed legislation, certain late unemployment payments would be exempt from taxation, providing much-needed financial relief for individuals who have already faced the challenges of being unemployed. This exemption would help to alleviate the burden of additional taxes on individuals who have already been struggling to make ends meet.

Overall, the Unemployment Tax Relief Act seeks to provide support for individuals who have been impacted by delays in receiving their unemployment benefits, ensuring that they are not further burdened by additional taxes on these much-needed payments.

Under the proposed legislation, certain late unemployment payments would be exempt from taxation, providing much-needed financial relief for individuals who have already faced the challenges of being unemployed. This exemption would help to alleviate the burden of additional taxes on individuals who have already been struggling to make ends meet.

Overall, the Unemployment Tax Relief Act seeks to provide support for individuals who have been impacted by delays in receiving their unemployment benefits, ensuring that they are not further burdened by additional taxes on these much-needed payments.

Congressional Summary of HR 7350

This bill excludes from the gross income of a taxpayer up to $10,200 in unemployment compensation issued to the taxpayer for calendar year 2020, but not received until 2021. This exclusion applies to taxable years beginning after December 31, 2020.

Read the Full Bill

Current Status of Bill HR 7350

Bill HR 7350 is currently in the status of Bill Introduced since March 31, 2022. Bill HR 7350 was introduced during Congress 117 and was introduced to the House on March 31, 2022. Bill HR 7350's most recent activity was Referred to the House Committee on Ways and Means. as of March 31, 2022

Bipartisan Support of Bill HR 7350

Total Number of Sponsors

1Democrat Sponsors

1Republican Sponsors

0Unaffiliated Sponsors

0Total Number of Cosponsors

30Democrat Cosponsors

30Republican Cosponsors

0Unaffiliated Cosponsors

0Policy Area and Potential Impact of Bill HR 7350

Primary Policy Focus

TaxationAlternate Title(s) of Bill HR 7350

To amend the Internal Revenue Code of 1986 to exempt certain late unemployment payments from taxation.

To amend the Internal Revenue Code of 1986 to exempt certain late unemployment payments from taxation.

Comments

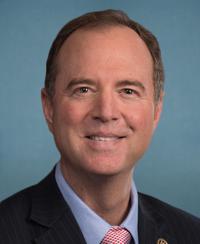

Sponsors and Cosponsors of HR 7350

Latest Bills

National Defense Authorization Act for Fiscal Year 2026

Bill S 1071December 11, 2025

Electric Supply Chain Act

Bill HR 3638December 11, 2025

State Planning for Reliability and Affordability Act

Bill HR 3628December 11, 2025

Increasing Investor Opportunities Act

Bill HR 3383December 11, 2025

ASCEND Act

Bill S 1437December 11, 2025

Providing for consideration of the bill (H.R. 3001) to advance commonsense priorities.

Bill HRES 486December 11, 2025

Snow Water Supply Forecasting Reauthorization Act of 2025

Bill HR 3857December 11, 2025

Federal Firefighters Families First Act

Bill HR 759December 11, 2025

ADS for Mental Health Services Act

Bill S 414December 11, 2025

Providing for consideration of the bill (H.R. 2550) to nullify the Executive Order relating to Exclusions from Federal Labor-Management Relations Programs, and for other purposes.

Bill HRES 432December 11, 2025